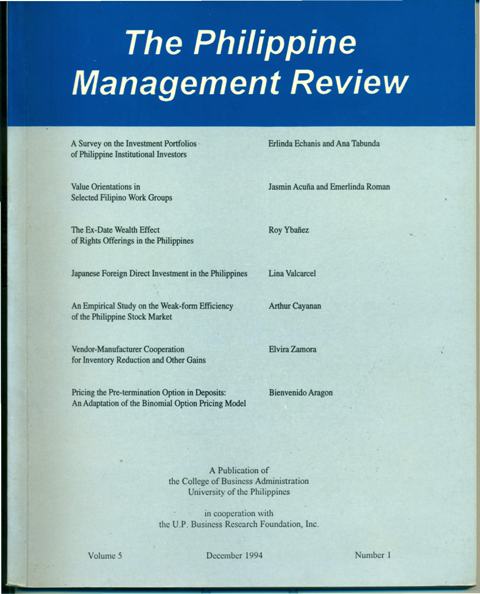

A Survey on the Investment Portfolios of Philippine Institutional Investors

Abstract

The study gathered data (from December 1993 to February 1994) on the profile of the investment portfolios of Philippine institutional investors, their criteria in making investment decisions and their investment decision processes and performance practices. The 179 sample firms had a total investment portfolio of approximately P600 Billion. Results of the study showed that the investment portfolios of Philippine Institutional Investors are dominated by government securities and foreign currency. Furthermore, investments in publicly listed stocks comprised a very small percentage (only 2% of the total portfolios) mostly placed in blue-chip commercial-industrial stocks. Other findings include: 1) investment portfolios are not diversified; 2) investors consider “liquidity” as an important factor in the selection of an investment instrument, and 3) the use of T-bills interest rate as a performance measurement criterion discouraged the investment in publicly listed stocks.