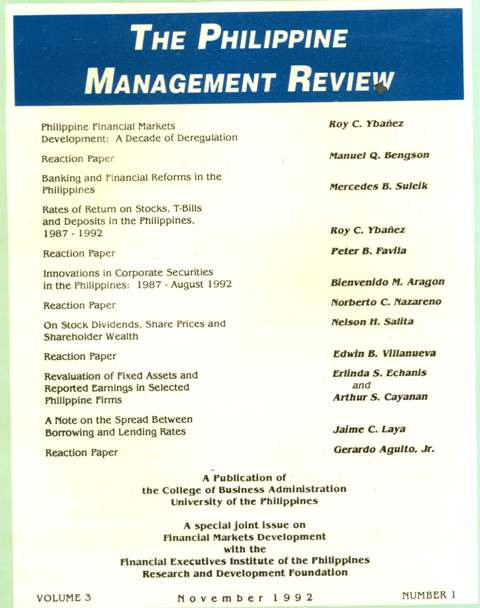

Philippine Financial Markets Development: a Decade of Deregulation

Abstract

This paper reviews the development of Philippine financial markets in the 1980s, covering a full decade of financial liberalization and interest rate deregulation. The extent of financial intermediation in the economy as measured by the M3/GDP ratio, hardly changed. However, there has been a shift from deposit substitutes to deposits, and an expansion of off-balance sheet activities. The long-term capital market remains relatively undeveloped, nor has universal banking produced a significant shift to long-term lending or to investments in non-allied undertakings. The positive developments include signs of an emerging long-term securities market and a revitalized stock market. Public sector borrowings have significantly increased, and interest rates have risen and become more volatile. The paper suggests the following to enhance financial markets development: greater macroeconomic stability, particularly in prices and interest rates; a regulatory structure that fosters information efficiency, competition and stability; the development of a long-term government securities market; and the encouragement of a greater supply of private securities.